The mining industry in Latin America can only prosper in the coming years as all necessary factors are in place to make the mining sector the driving force for economic growth and prosperity in the region.

The mining industry in Latin America can only prosper in the coming years as all necessary factors are in place to make the mining sector the driving force for economic growth and prosperity in the region.

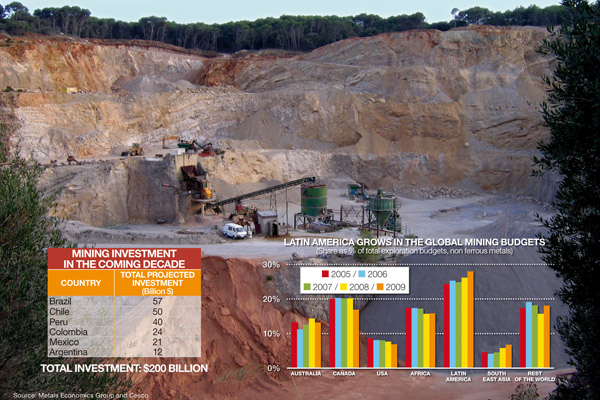

The reason for the boom is due to the influx of investments that the region has received in the recent past and that is expected to receive in the next decade. According to the Center for Studies on Copper and Mining (Cesco, in Spanish), a research center based in Santiago (Chile), over $200 billion will be invested during the next 10 years.

According to Cesco’s findings, the last 2 years have been filled with great challenges and transformations throughout the worldwide mining sector. In 2008 all industrial sectors collapsed as a result of the global crisis, including those in Latin American economies.

However, the growing Chinese demand for natural resources has boosted the recovery of the global mining sector and of the Latin mining sector, more specifically. According to the Metals Economics Group (MEG), a mining research firm based in Canada, since 1993 the Chinese consumption of natural resources exceeded what was available domestically, hence China’s need to seek resources from the rest of the world.

MEG indicates how in recent years, China joined the international market for natural resources. Between 2004 and 2010, the Chinese expenditure of international metals jumped from $530 million to $7.8 billion.

The boom in the price of commodities has been stable in recent months and it has been stimulated by global investment trends. Not only are mining companies investing in the search for precious metals, but global investors are as well. In the face of the uncertainty of the economic crisis, investors have looked for refuge with gold and other precious metals, thus driving up the price of commodities.

Additionally, some believe that the American monetary policy, oriented towards injecting large amounts of liquidity into the economy in order to stimulate recovery, has also increased the price of commodities because part of the money injected in the U.S. is invested in commodities from emerging markets because of the higher returns that are available in other countries.

MPA

Últimos Noticias

-

Asociaciones indígenas reclaman por calificación ambiental favorable de proyecto Collahuasi

Siete asociaciones indígenas de la comuna de Pica, en la Región de Tarapacá, en Chile, ingresaron una reclamación ante el Primer Tribunal Ambiental por la calificación ambiental favorable del proyecto…

-

Bolivia: YLB proyecta ingresos por más de USD 77 millones para esta gestión

La empresa Yacimientos de Litio Bolivianos (YLB) anunció que proyecta ingresos por Bs 533 millones (más de USD 77 millones) para esta gestión por la venta de carbonato de litio,…

-

Perú: Amsac ejecutará obras de remediación de pasivos ambientales por más de USD 38 millones

Antonio Montenegro, gerente general de la empresa pública Activos Mineros – Amsac, señaló que su Presupuesto Inicial de Apertura (PIA) para este 2024 asciende a alrededor de los S/ 145…

-

Anglo American: producción de mineral de hierro aumentó un 4% en Brasil

Anglo American publicó los resultados del primer trimestre de 2024, incluidas las operaciones brasileñas. El informe muestra que la producción de mineral de hierro de la empresa en Brasil aumentó…

-

Perú: Raúl Benavides Ganoza asume la presidencia de Minera El Brocal

La Sociedad Minera El Brocal informó que Raúl Benavides Ganoza asumirá la presidencia del directorio de la empresa, según consta en el reporte de Hechos de Importancia enviado a la…

-

Anglo American: producción de cobre crece un 11 % gracias a proyectos de Perú y Chile

La producción de cobre se incrementó en 11 % a 198 100 toneladas, gracias al aumento de 21% de Quellaveco en Perú y al alza de 6% en la producción…

-

Bolivia: Construcción del Complejo Siderúrgico del Mutún alcanza el 87% de avance

El Ministro de Minería y Metalurgia (MMM), Alejandro Santos Laura, visitó el municipio fronterizo de Puerto Suarez, provincia German Bush,en el departamento de Santa Cruz, y constató que ya existe…

-

Bolivia: Planta Industrial de Carbonato de Litio en Uyuni continúa operando

La Planta Industrial de Carbonato de Litio, instalada en el salar de Uyuni, departamento de Potosí, continúa en operaciones y tiene garantizada la materia prima, afirmó este miércoles el viceministro…

-

JLG Industries celebra 25 años de éxito e innovación en Brasil

JLG Industries, una empresa de Oshkosh Corporation y fabricante líder mundial de plataformas elevadoras móviles de personal (PEMP) y manipuladores telescópicos, conmemoró recientemente un importante hito corporativo: 25 años de…

-

Tomra Mining: un punto de partida sostenible para los recursos que transformarán nuestro mundo

La industria minera desempeña un papel esencial en el mundo presente y futuro. En su nuevo vídeo de marca, que lleva por título “Clasificando los recursos del mañana” (Sorting tomorrow’s…